If you’re a small business owner and you’re not set up to accept online payments, you’re probably either leaving money on the table, or you’re creating an inconvenience for a significant portion of your customers.

I know what you’re thinking. “It’s not that hard to write a check and mail it.”

You’re right. It’s not, but we live in a world today where a rapidly growing portion of the population doesn’t even own checks, because all of their bills are paid electronically (myself included).

While Baby Boomers and Generation X may be used to writing checks, addressing envelopes, keeping stamps on hand, and getting papercuts, this is a huge headache for the Millenial generation and their desire for speed and convenience. Many millenials have never even owned a checkbook, and have no intentions on doing so.

Fortunately, for those customers that ask for it (and for those that haven’t yet) there is a very easy way to get paid for your services online, even if you don’t have a website. Odds are that you’ve probably heard of it before.

Paypal is, by far, the most trusted and most widely adopted online payment method that exists today. The only thing you need to set it up is an email address and a bank account, which you should already have if you’re operating a business in today’s world.

PayPal is extremely flexible. You can go as far as integrating it into your website to accept payments directly online (which we’ve done for a few customers), or you simply provide your PayPal email address to your customers on their invoices.

Both methods will get you paid instantly. The latter is how I would recommend you start, and will take 15 minutes or less to do.

This will also save you a ton of time down the road, because for those customers that pay you digitally, you won’t have to worry about messing with paper checks or running to the bank every time you want to make a deposit. This can save you several hours each and every month and you get your money even faster.

Here are the steps to accept online payments for your small business.

Create a PayPal Account to Accept Online Payments

Your first step is to create your PayPal account. This will allow you to accept online payments and will store them until you transfer it to your business bank account. Customers can pay by credit card, bank draft, or their own PayPal account balance.

All of this is 100% secure and automated. You don’t have to worry about taking credit card numbers, bank account numbers, or messing with depositing checks from your customers. All you do is send them your PayPal ID and the money arrives in your account instantly when they pay you.

Get started by creating your Business PayPal Account here. Make sure you complete all of your business information up front so your customers know who they are paying, etc.

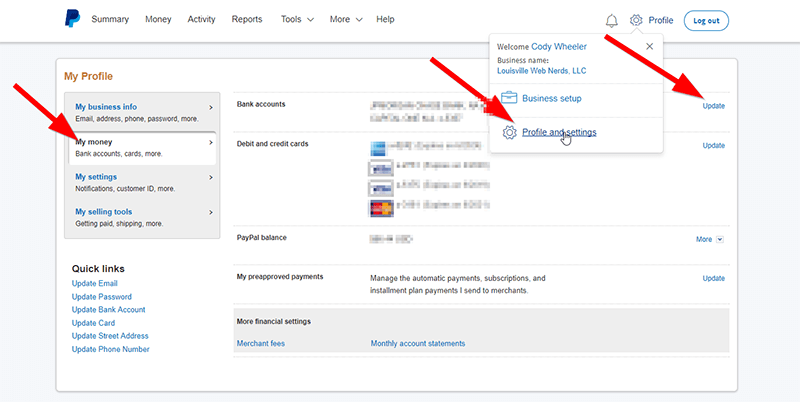

Link PayPal to Your Business Bank Account

This will likely be done during the setup process, but it’s important to call out specifically. Linking your business bank account to your PayPal account is what will allow you to transfer the money you get paid to your bank account. Otherwise it will just sit in your PayPal account. You can still spend it from there, but only through PayPal.

This process typically just requires an online authentication with your bank, and assumes you have your bank account online access set up already.

To get started, go to Profile and Settings at the top under the gear icon, then My Money, then click Update next to Bank accounts. Follow the prompts from there to hook things up.

As a side benefit, linking your bank account to PayPal will also allow you to pay your vendors securely using PayPal if you choose. From this screen you can also add business credit cards and debit cards if you would like to use those to pay vendors as well.

Add Your PayPal Email Address to Your Invoices

A great benefit to PayPal is someone can pay you using only your email address. For example, to send a payment to us, you would simply login to your PayPal account and send a payment to “help@louisvillewebnerds.com” in the amount of your invoice.

That’s what you would tell someone when they ask you how they can pay online. “Just send a PayPal payment to (insert your PayPal email address).”

PayPal explains how to send money here using their tools. If people are asking, most people will already know how to do this. If not, you can send them an invoice by using the PayPal invoice feature under Tools, which is extremely easy to use. This will allow you to send an invoice directly to their email address with a link for them to click to pay you.

You can also create buttons, links, etc for specific amounts and things like recurring payments, but the email address is the simplest way.

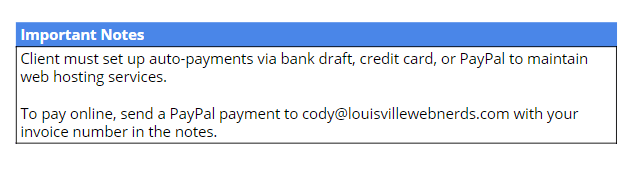

What I recommend doing to start is simply adding a note to the payment information section of your invoice with your PayPal email address. This can be something like, “To pay online, send a PayPal payment to (insert your PayPal email address) with your invoice number in the notes.”

Here is a screenshot of one of our invoices where we call out this payment method. Very simple, yet very effective.

Communicate This Feature to Your Customers

A lot of your customers may overlook the invoice note, so if you have an email database, you can send a note to your customers letting them know that they can now pay you online. You can also create a blog post on your website announcing this news, or even send a mail insert if you’re still sending paper invoices.

If you need help creating a website, check out our Small Business Websites service.

Decide How You Will Handle PayPal Fees

While PayPal will save you a lot of hassle, and open up your business to new customers, it does come with a small cost, but only when you receive money. You can read about PayPal fees here.

You’ll essentially pay 2.9% of each transaction, plus a flat $0.30 per transaction. So on a $100 transaction, you would keep $96.80 ($100 – ($2.90 + $0.30)). Personally, I think it’s a small price to pay to be able to easily and securely accept essentially any method of payment instantly.

What you’ll want to decide is how to handle these fees. You can either choose to accept the fees yourself as a cost of doing business (which is what I recommend), or you can pass the fees along to your client as a service charge (not very customer-centric in my honest opinion). I’ve seen both done.

You can use this handy PayPal Fee Calculator to calculate your fees in either case.

The latter is definiltely more difficult because you need to adjust your invoices based on how a customer wants to pay. Sure, it’s not free, but if there is value to your business, which there definitely is, it should cost something. You also get a plethora of valuable capabilities that you cannot do with paper checks, such as setting up subscriptions for your services (which makes recurring accounts far easier to deal with).

Look at it this way. If you get just ONE additional customer, the few extra dollars here and there is absolutely worth it.

So, What Should You Do Next?

This is a complete end-to-end guide with every step you need to take to accept online payments using PayPal. If you feel like you can do all of this yourself, take a few minutes and get it set up! Your customers will love it.

If you’d like help, we’ll gladly provide guidance and answer questions along the way under our hourly rates, and we’ll even let you pay us by PayPal after as your first test!

Just get in touch with us on our Contact Page and we’ll be happy to help!